Health Insurance & Social Security Number

Health Insurance & Social Security Number

In Germany, it is mandatory to have a health insurance. Generally speaking, there are two different types of

health insurance:

National Health Insurance (gesetzliche Krankenversicherung - GKV)

If you earn less than EUR 5,775 per month (this cap is the amount valid for 2024, it is adjusted every year) you have to register with the national health insurance gesetzliche Krankenkasse, (e. g. Techniker Krankenkasse – TK or Siemens Betriebskrankenkasse – SBK amongst others). They work according to the social principle, i.e. only the working family members pay contributions depending on their salary. Currently, the contributions for employees are normally 7.3% of your gross monthly income (the employer contributes the other 7.3%).

Most insurances also charge an additional premium (Zusatzbeitrag) which is shared between employer and employee. It can vary between 0.5% and 1.7%, but is normally around 1.0% of your gross monthly income. If your gross monthly income exceeds EUR 5,175 (this cap is the amount valid for 2024, it is also adjusted every year), then contributions are only paid for earnings up to this amount. The non-working family members

(housewives, children, students) are covered through the working members’ contributions. Each family member has a health insurance card which has to be presented at every visit to the doctor.

Private Health Insurance (private Krankenversicherung - PKV)

If your salary has exceeded EUR 5,775 per month in the past 2 years, you can choose between the national and private health insurance. Private health insurance may seem more advantageous due to lower contributions for young professionals without a family, but please be aware of the following:

Please keep in mind that the application process can take several weeks.

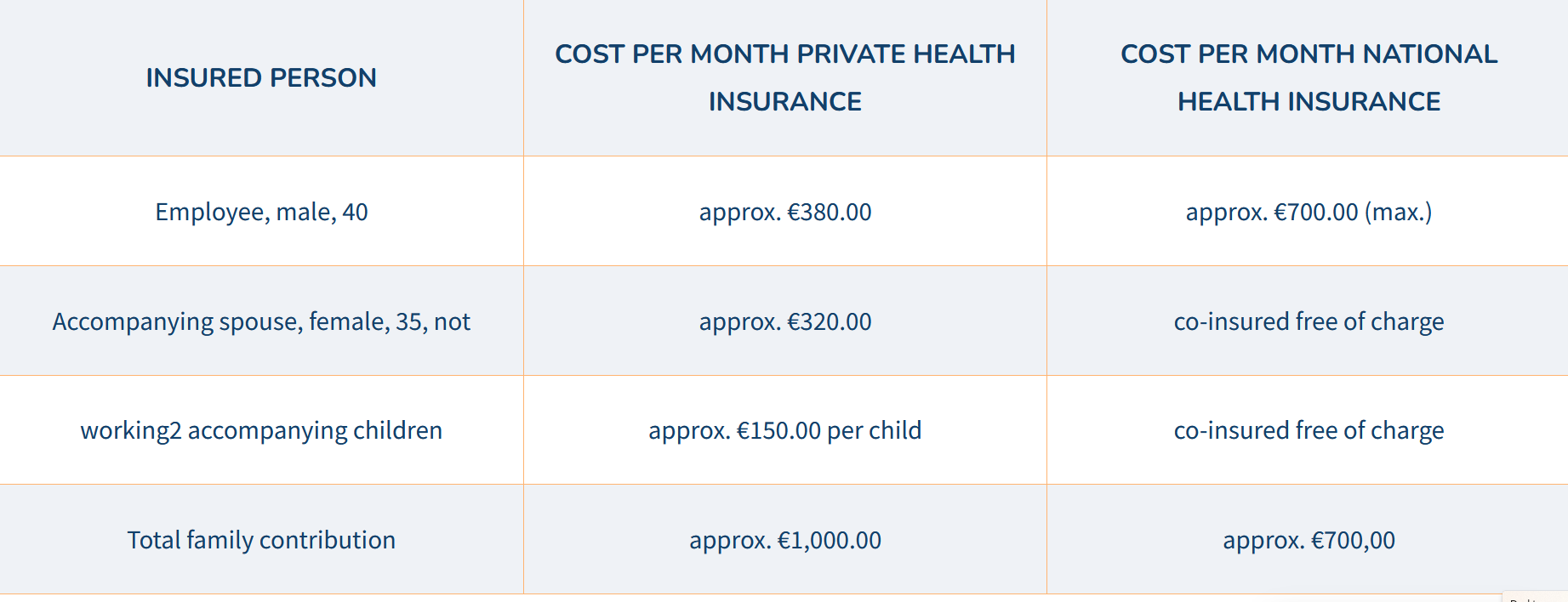

Example for a health insurance coverage:

Insured person | Cost per month private health insurance | COST PER MONTH national health insurance |

|---|---|---|

Employee, male, 40 | approx. €380.00 | approx. €700.00 (max.) |

Accompanying spouse, female, 35, not | approx. €320.00 | co-insured free of charge |

working2 accompanying children | approx. €150.00 per child | co-insured free of charge |

Total family contribution | approx. €1,000.00 | approx. €700,00 |

Application is made directly with the health insurance. Please contact your Relocation Specialist at BLUE for

assistance.

In Germany, it is mandatory to have a health insurance. Generally speaking, there are two different types of health insurance:

National Health Insurance (gesetzliche Krankenversicherung - GKV)

If you earn less than EUR 5,775 per month (this cap is the amount valid for 2024, it is adjusted every year) you have to register with the national health insurance gesetzliche Krankenkasse, (e. g. Techniker Krankenkasse – TK or Siemens Betriebskrankenkasse – SBK amongst others). They work according to the social principle, i.e. only the working family members pay contributions depending on their salary. Currently, the contributions for employees are normally 7.3% of your gross monthly income (the employer contributes the other 7.3%).

Most insurances also charge an additional premium (Zusatzbeitrag) which is shared between employer and employee. It can vary between 0.5% and 1.7%, but is normally around 1.0% of your gross monthly income. If your gross monthly income exceeds EUR 5,175 (this cap is the amount valid for 2024, it is also adjusted every year), then contributions are only paid for earnings up to this amount. The non-working family members

(housewives, children, students) are covered through the working members’ contributions. Each family member has a health insurance card which has to be presented at every visit to the doctor.

Private Health Insurance (private Krankenversicherung - PKV)

If your salary has exceeded EUR 5,775 per month in the past 2 years, you can choose between the national and private health insurance. Private health insurance may seem more advantageous due to lower contributions for young professionals without a family, but please be aware of the following:

Please keep in mind that the application process can take several weeks.

Application is made directly with the health insurance. Please contact your Relocation Specialist at BLUE for

assistance.

After registering with a National German health insurance, you will receive your social insurance (security)

number by post. Please ensure that your name is on your mailbox!

You will have to give your social security number to your employer. In addition, you will also need it whenever

you wish to contact Deutsche Rentenversicherung (German pension insurance authority).

PLEASE LOOK WELL AFTER THIS DOCUMENT!

After registering with a National German health insurance, you will receive your social insurance (security) number by post. Please ensure that your name is on your mailbox!

You will have to give your social security number to your employer. In addition, you will also need it whenever you wish to contact Deutsche Rentenversicherung (German pension insurance authority).

PLEASE LOOK WELL AFTER THIS DOCUMENT!